The Political and Business Institutions as Obstacles to Civilization's Resilience: Part III

© Lucas Jackson / Reuters

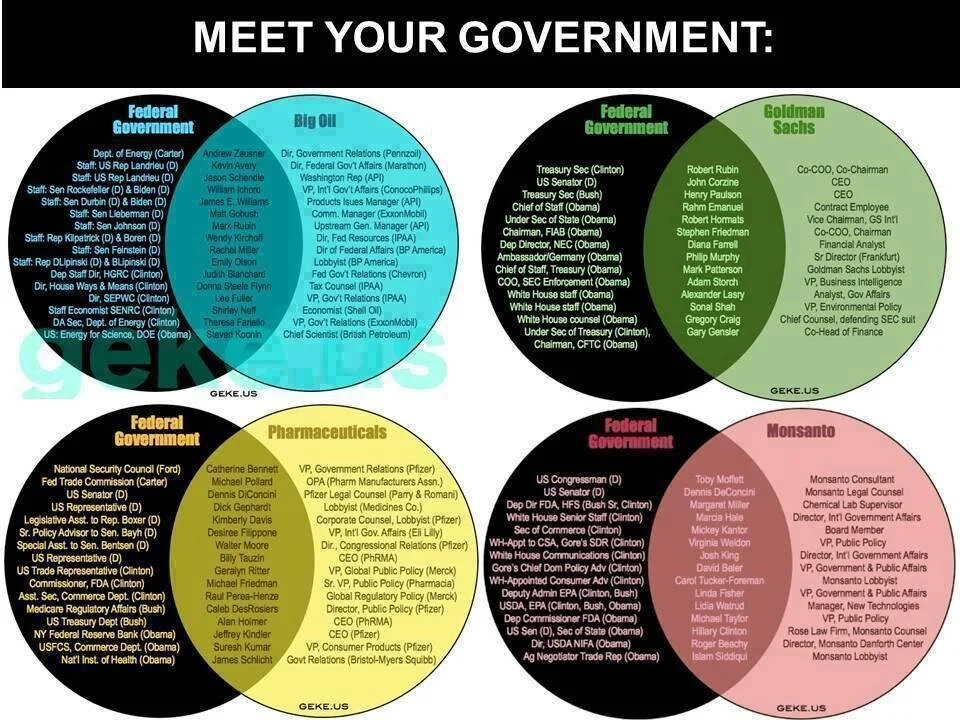

The “revolving door” elites who pillaged the American taxpayer in the Great Recession debacle did not brandish the kind of celebrity status of the Iraq debacle. They are of a different category. They are the East Coast elite of finance, insurance, and real estate, not the oil and military money. Take Robert Rubin. Among his many governmental, business, and university positions, Rubin worked for over twenty years at the largest investment bank, Goldman Sachs, then served under President Clinton for six years, the last four as the United States Secretary of the Treasury. Rubin’s last act in his role as Treasury Secretary was to spearhead the repeal of the Glass-Steagall Act, which had been emplaced in 1933 to prevent another Great Depression.[i] Since millions of Americans had unknowingly lost all their savings in risky investments made by their banks in the 1920s, the act, among other things, separated the activities of banking and investment and guaranteed the money of depositors in commercial banks.[ii] Some economists have credited this firewall for sixty years of relative economic stability.[iii] To be fair, others have argued that it has made American banks less competitive on the world stage.[iv] They may be both be true. For most Americans, the first may be more important, as there had been numerous highs and lows within the American economy but no major busts since the enactment of Glass-Steagall. Interestingly, after its repeal by the Commodity Futures Modernization Act, Rubin immediately quit his post and was hired by Citigroup, the world’s largest bank at the time and the biggest potential beneficiary of the Act’s repeal.[v] Within a decade, the U.S. economy experienced a complete meltdown—its first since the Great Depression—fueled principally by the speculative behaviors that Glass-Steagall had been enacted to prevent.[vi] Only a $300 billion-plus government bailout prevented Citigroup’s demise.[vii] Meanwhile, Rubin left Citigroup with $126 million in stocks and money and went on to work on Obama’s transition team in 2008. He placed a number of his protégés in prominent positions in the Obama White House, among them Treasury Secretary Timothy Geithner and Senior White House Economic Advisor Lawrence Summer.[1] These latter two also have an impressive history of moving through the stratosphere of elite financial and governmental roles, and their involvement in the upward redistribution of wealth is the stuff of conspiracy stories and Hollywood movies.[viii] And it wasn’t just these two. The Obama administration flooded the financial oversight positions with executives from the likes of Merrill Lynch, Citigroup, and especially Goldman Sachs (or as the firm is affectionately referred to, Government Sachs).[ix]

As incoming president, Barak Obama promised to “close the revolving door” between business and government. His Ethics Executive Order required that new appointees recuse themselves from “any particular matter involving specific parties that is directly and substantially related to [their] former employer or former clients, including regulations and contracts” for two years.[x] However, he immediately sought a waiver for this policy when he nominated the chief lobbyist for Raytheon, William Lynn, as Deputy Secretary of Defense. Raytheon was the world’s fifth largest military contractor and the nation’s fourth largest.[xi] Others followed.[xii] To mention just three of them…

Islam Siddiqui: After having worked for CropLife America as a lobbyist for biotech companies, Islam Siddiqui became Obama’s Chief Agricultural Negotiator, U.S. Trade Representative.

William Magwood: After a career as a proponent of nuclear energy, which included positions at Westinghouse, Edison Electric, and the DOE’s Office of Nuclear Energy, Science and Technology, William Magwood became Obama’s Commissioner of the Nuclear Regulatory Commission.[xiii] It did not take long for Westinghouse and the nuclear industry to benefit. In December 2011, in the wake of the Fukushima disaster in Japan and despite warnings from the Union of Concerned Scientists, the Nuclear Regulatory Agency approved the Westinghouse AP1000 reactor design and “waived the usual 30-day waiting period before its approval became official.[xiv] This cleared the way for construction of the first two nuclear power plants in the United States since the partial meltdown in 1979 at the Three Mile Island nuclear plant, and, according to the Nuclear Power Daily “will help Westinghouse sell more reactors overseas.”[xv] With a price tag of about three billion dollars each, China will be buying at least eight of the AP1000s.[xvi]

Mary Jo White: Served brilliantly at the U.S. Attorney’s office for ten years and then joined the elite law firm of Debevoise & Plimpton where, for another ten years, she defended some of the biggest names on Wall Street, including Kenneth Lewis, the former CEO, president, and chairman of Bank of America, and John Mack, former CEO of the major investment bank and brokerage firm Morgan Stanley. Obama nominated Mary Jo White to head the Securities Exchange Commission (SEC), the federal agency whose charge it is to regulate and enforce the same Wall Street businesses that had previously been her clients.[xvii] As Matt Taibbi in the Rolling Stone headlined it, “Choice of Mary Jo White to Head SEC Puts Fox in Charge of Hen House.”[xviii]

To be fair, the wielding of power within the United States has not been completely one-sided. In the interests of the citizen and of the environment there have been dozens of legislative victories in the United States. The Clean Air Acts of 1970, 1977 and 1990, particularly, have been generally considered remarkable success stories.[xix] There were also the important but incomplete victories of the Clean Water Act of 1972, the Endangered Species Act in 1972, the Safe Drinking Water Act in 1974, the National Energy Act in 1978, the Superfund Law in 1980, and the creation of the Environmental Protection Agency (the EPA) under Richard Nixon’s direction in 1970.[xx] Among the many pieces of social legislation, some of the most significant include the Sherman Antitrust Act in 1890; the Nineteenth Amendment, ratified in 1920, giving women the right to vote; the Social Security Act of 1935, which institutionalized the caring for those in need; the Wagner Act, also in 1935, which protected a worker’s right to bargain collectively; and the Civil Rights Act of 1964, which outlawed major forms of discrimination for reason of race and gender.

Given the extraordinary power of these legislative victories to affect change, it seems reasonable that New York Times opinion editorial writer Thomas Friedman would conclude in his book Hot, Flat and Crowded that “It is more important to change your leaders than your lightbulbs. Leaders write the rules and regulations, and the rules and regulations shape markets and change the behavior and incentives of millions of people at once.”[xxi] And, indeed, due to the legislative action of government leaders—namely, the 2007 Energy Independence and Security Act—the energy-wasting incandescent light bulbs were to be phased out, starting with the 100-Watt bulb in January of 2012.[xxii]

With one signing of the pen, the hand of George Bush II exercised far more power than could be mustered by the sum of all the dedicated individuals in the country, the consumers, the advocates, the green entrepreneurs, encouraging innovations in light bulb technology, saving millions of tons of fossil fuels, many tons more of carbon emissions, and setting off a ripple effect in the multi-dimensional pond of our global ecosystem. Three-hundred million Americans multiplied by all the light bulbs they use, with but one signature. However, a month before the bill was to come in effect, Congress with Obama’s signature, found a way to delay this one simple baby step toward sustainability.[xxiii] Within the multi-trillion dollar 2012 spending bill lay a provision that prevented the Department of Energy from enforcing the previous light bulb bill. No wonder that in the closing pages of his book, Thomas Friedman concludes, “… if we are to summon the will, focus and authority to push through a real green revolution, we will need a president who isn’t afraid to do whatever it takes to lead it.” Written when George Bush II was president, little substantially changed during the Obama administration.[xxiv]

For similar reasons, analysts from all disciplines and political stripes consistently cite the lack of “political will” in Washington as the primary source of the country’s biggest problems, including food, energy, and economic insecurity.[xxv] It was the reason given by Standard & Poors on August 5, 2011 for downgrading the U.S. credit rating for the first time in the seventy-year ratings history. The United States had failed to show the political will necessary to control its ballooning national debt, which at that point was $14.4 trillion.[xxvi]

And in dealing with the environmental crisis, the U.S government has been even less sage. In 2007, the American government—with George Bush II’s signature—mandated ambitious biofuel goals, although there was clearly little wisdom in devoting huge swaths of fertile American soil to producing relatively insignificant quantities of energy.[xxvii] In 2006, ethanol-production slurped up 35% of federal subsidies for energy.[xxviii] Fossil fuels took 46% of the government largesse, nuclear 9%, and wind and solar received but a paltry 6%.[xxix] In 2012, the U.S. Congress threatened to let solar and wind power subsidies expire, although coal, oil, nuclear, and ethanol continued to receive their usual share.[xxx] Meanwhile, those scientists trained and employed to study the matter have been calling for huge, expensive, and immediate efforts for alternative energy sources that must be “pursued with the urgency of a Manhattan Project or Apollo Space Programme.”[xxxi] Members of Congress and the Executive Branch are some of the best-informed people in the world, so their inaction cannot be a function of simple ignorance. More likely, the objectives of their “political will” do not coincide with ours.

REFERENCES

[1] In 2007, Citigroup had sold toxic mortgage-backed securities and then “shorted” them. That is, they knowingly stuffed the portfolios of unsuspecting customers with risky mortgage-related investments and then bet in other futures markets that that these “securities” would fail. To settle multi-billion dollar fraud charges that occurred under the Rubin chairmanship, in 2011 Citigroup paid $285 million in a suit brought by the SEC (Egan, 2011); in 2012 Citigroup paid $590 million to its shareholders (Touryalai, 2012); and in 2013 Citicorp agreed to pay $730 to bond investors (Faux and Hurtado, 2013).

Egan, M. (2011, October 19) Citi to Pay $285M to Settle Charges it Misled Investors. Fox Business.

Touryalai, H. (2012, August 29) Citi to Pay$590 Million To Burned Shareholders in Toxic Asset Case. Forbes.

Faux, Z. and Hurtado, P. (2013, March 19) Citigroup to Pay $730 Million in Bond-Lawsuit Settlement. Bloomberg. Available at http://www.bloomberg.com/news/2013-03-19/citigroup-to-pay-730-million-in-bond-lawsuit-settlement.html. Accessed March 29, 2013.

[i] Some in more recent years disputed both this characterization of the Glass-Steagall Act and that the Depression had been caused by investor speculation of commercial deposits: for example, Kroszner and Rajan (1994), Barth et al. (2000).

Kroszner, R.S., and Rajan, R.G. (1994) Is the Glass-Steagall Act Justified? A Study of the U.S. Experience with Universal Banking Before 1933, The American Economic Review, v. 84(4), pp. 810-832.

Barth, J.R., Brumbaugh Jr., R.D., and Wilcox, J.A. (2000) The Repeal of the Glass-Steagall and the Advent of Broad Banking, Journal of Economic Perspectives, v. 14(2), pp. 191-204.

[ii] Kroszner and Rajan (1994); Barth et al. (2000); Drum, K. (2010, Jan/Feb) Capital City, Mother Jones, pp. 37-79. Accessed April 1, 2017 at http://www.motherjones.com/politics/2010/01/wall-street-big-finance-lobbyists.

[iii]Heintz and Travisano (1998), Davidson (2008).

Heintz, N.T., and Travisano, R.M. (1998) What is Past is Prologue: Why Congress Should Reject Current Financial Reform Bills and Breathe New Life Into Glass-Steagall, Journal of Civil Rights and Economic Development, v. 13(2), pp. 373-398.

Davidson, P. (2008) How To Solve The U.S. Housing Problem and Avoid A Recession: A Revived HOLC and RTC, MPRA Paper No. 7427, Munich Personal RePEc Archive.

[iv] Tavelman (1992), Bartlett (2012).

Tavelman, F.M. (1992) American Banks or the Glass-Steagall Act—Which Will Go First? Sw. UL Rev., v. 21, pp. 1511-1512.

Bartlett, S. (2012, September 17) Diversified Banks are More Stable, USNews.

[v] Kahn (1999), Calmes (2008), Dash and Story (2009), Drum (2010). Although the actual signing of the repeal (the Gramm-Leach-Bliley Act) by president Bill Clinton occurred on November 12, 1999, the Senate passed its version on May 6, 1999, and the House of Representatives passed it version on July 1, 1999. The next day—on July 2—Robert Rubin resigned his post as Secretary of the Treasury. Three months later, in October, he joined Citigroup as a co-chairman (Kahn, 1999).

Kahn, J. (1999, October 27) Former Treasury Secretary Joins Leadership Triangle at Citigroup, New York Times.

Calmes, J. (2008, November 24) Obama's economic team shows influence of Robert Rubin - with a difference, New York Times.

Dash, E. and Story, L. (2009, January 9) Rubin Leaving Citigroup; Smith Barney for Sale, New York Times.

Drum, K. (2010, Jan/Feb) Capital City, Mother Jones, pp. 37-79.

[vi] Harding, S. (2012, May 21) Bringing Back Glass-Steagall Would Rebuild Shattered Confidence in Wall Street, Forbes. The Dodd-Frank Bill in 2009-2010 was aimed at placing band aids on the Financial Services Modernization Act that had repealed the Glass-Steagall bill after the economic meltdown of 2008. However, it met stiff resistance by the finance industry, which spent $1.3 billion on lobbyist to fight the bill and vowed to continue the fight after its passage (Rivlin, G. (2011, July 18) The Billion-Dollar Heist: How The Financial Industry Is Buying Off Washington—And KillingReform, Newsweek, pp. 9-11.)

[vii] Dash (2008), Wilchins and Stempel (2008), Drum (2010), Nicholson (2011).

Dash, E. (2008, November 23) Citigroup to Halt Dividend and Curb Pay, New York Times.

Wilchins, D., and Stempel, J. (2008, November 24) Citigroup gets Massive U.S. Government Bailout. Reuters.

Nicholson, C.V. (2011, January 14) Citi’s Bailout: Ad Hoc Rescue for an Unwilling Bank, New York Times.

[viii] For the sad details, see Prins, N. (2011) It Takes a Pillage: An Epic Tale of Power, Deceit, and the Untold Trillions. John Wiley & Sons, Inc., Hoboken, NJ.

Kroll, A. (2010, Jan/Feb) Henhouse, Meet Fox, Mother Jones, p. 38.

[x] Kravitz, D. (2009, January 23) Obama Nominee Runs Into New Lobby Rules Washington Post.

[xi] Corn, D., Schulman,D., and Sheppard, K. (2010 Jan/Feb) Obama’s Worst Nominees, Mother Jones, p. 25..

[xii] See OpenSecrets.org (2011) Revolving Door. Available at http://www.opensecrets.org/revolving/index.php.

[xiii] Corn, Schulman and Sheppard (2010). In 2011, Magwood was one of three members of the Nuclear Regulatory Commission who voted to approve a reactor model designed by his old employer, Westinghouse (Platts, 2011).

[xiv] Nuclear Power Daily (2011), Olson (2011), Schwartzel (2011), Wald (2011).

Nuclear Power Daily (2011, December 23) Westinghouse nuclear reactor gets go-ahead.

Olson, T. (2011, December 14) Nuclear regulators leaning toward approval of Westinghouse reactor, Pittsburgh Tribune-Review.

Schwartzel, E. (2011, December 23) Westinghouse’s newly designed nuclear reactors approved, Pittsburg Post-Gazette.

Wald, M.L. (2011, December 22) Approval of Reactor Design Clears Path for New Plants, New York Times. Available at http://www.nytimes.com/2011/12/23/business/energy-environment/nrc-clears-way-for-new-nuclear-plant-construction.html. Accessed December 24, 2011.

[xv] Nuclear Power Daily (2011), Schwartzel (2011).

[xvi] Schwartzel (2011), Steiner-Dicks (2014).

Steiner-Dicks, K. (2013, April 23) Westinghouse Prepares for $24bn China Opportunity; Others Getting in on the Action. Nuclear Energy Insider.

[xvii] Bobelian (2013), Cassidy (2013), Matthews (2013), Taibbi (2011, 2013). T

Bobelian, M. (2013, January 25) What Should the SEC Expect from Mary Jo White, Forbes.

Cassidy, J. (2013, January 25) Two Reasons Why Mary Jo White is a Bad Choice for the S.E.C., The New Yorker.

Taibbi, M. (2011, February 16) Why Isn’t Wall Street in Jail? Rolling Stone.

Taibbi, M. (2013, January 25) Choice of Mary Jo White to Head SEC Puts Fox In Charge of Hen House, Rolling Stone.

[xviii] Taibbi (2013).

[xix] Miller, G.T., and Spoolman, S.E. (2009) Living in the Environment: Concepts, Connections, and Solutions, Sixteenth Edition. Brooks/Cole, Belmont, CA.. Environmentalist agree that there is much more to be done; the regulated community generally feels that government has already overstepped its jurisdiction.

[xx] Miller and Spoolman (2009).

[xxi] Friedman, T.L. (2008:397) Hot, Flat and Crowded: Why We Need a Green Revolution—and How it can Renew America, Firrar, Straus and Giraux, New York.

[xxii] Koch (2011a,b).

Koch, W. (2011a, April 27) Traditional Incandescent bulbs on their way out starting Jan. 1, USA Today.

Koch, W. (2011b, December 18) Congress’ bill may slow switch to efficient light bulbs, USA Today.

[xxiii] Cardwell, D. (2011, December 16) Despite Delay, the 100-Watt Bulb Is on Its Way Out, New York Times. Koch (2011a,b).

[xxiv] Broder, J.M. (2011, March 10) House Panel Votes to Strip E.P.A. of Power to Regulate Greenhouse Gases, New York Times.

[xxv] For example, Barber (1995:230), Svirezhev and Svirejeva-Hopkin (1998), Serageldin (1999), Fedoroff (2008), Howell (2009), McKibben (2010:175), Klein (2011). Klein persuasively argues that strong government action is necessary to deal with the climate crisis.

Barber, B.R. (1995) Jihad vs. McWorld: How Globalism and Tribalism are Reshaping the World, Ballantine Books, New York.

Svirezhev, Y.M., and Svirejeva-Hopkins, A. (1998) Sustainable Biosphere: Critical Overview of Basic Concept of Sustainability. Ecological Modeling, v. 106, pp. 47-61.

Serageldin, I. (1999) Biotechnology and Food Security in the 21st Century, Science, v. 285, pp. 387-389.

Fedoroff , N. (2008) Seeds of a Perfect storm. Science, v. 321, p. 425.

Howell, K. (2009, October 19) What is the Real Cost of Power Production, Scientific American.

McKibben, B. (2010) eaarth: Making a Life on a Tough New Planet. Times Books, Henry Holt and Company, New York.

Klein, N. (2011, November 9) Capitalism vs. the Climate, The Nation.

[xxvi] Goldfarb (2011), Eichengreen (2012). According to Standard & Poors (2011), “The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the Administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government'smedium-term debt dynamics. More broadly, the downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economicchallenges to a degree more than we envisioned when we assigned anegative outlook to the rating on April 18, 2011.”

Goldfarb, Z.A. (2011, August 5) S&P downgrades U.S. credit rating for first time, Washington Post.

Eichengreen, B. (2012, January/February) When Currencies Collapse: Will we Replay the 1930s or the 1970s? Foreign Affairs, v. 91(1), pp. 117-134.

Standard & Poors (2011, August 5) United States of America Long-Term Rating Lowered To “AA+' Due To Political Risks, Rising Debt Burden; Outlook Negative.

[xxvii] Govtrack.us (2007), Rosenthal (2011, April 6), Buyx and Tai (2011).

Govtrack.us (2007) H.R. 6 [110th] Energy Independence and Security Act of 2007.

Rosenthal, E. (2011, April 6) Rush to Use Crops as Fuel Raises Food Prices and Hunger Fears, New York Times.

Buyx, A., and Tait, J. (2011) Ethical Framework for Biofuels, Science, v. 332, pp. 540-541.

[xxviii] Ethanol also took forty percent of the U.S. corn crop in that year (Johnson, T. (2013, January 16) Food Price Volatility and Insecurity. Council on Foreign Relations.).

[xxix] Office of the Texas Comptroller (2008) Chapter 28: Government Financial Subsidies, The Energy Report 2008. Available at http://www.window.state.tx.us/specialrpt/energy/subsidies/. Accessed December 23, 2011.

[xxx] Kelly (2011), Smith (2012).

Kelly, E. (2011, June 28) Future of federal solar programs in doubt. USA Today.

Smith, M. (2012, April 18) U.S. Faces Clean Energy Bust as Subsidies Expire, Report Warns. CNN.

[xxxi] Quote from Hoffert et al. (1998). Also Somerville (2008).

Hoffert, M.I., Caldeira, K., Jain, A.K., Haites, E.F., Harvey, L.D.D., Potter, S.D., Schlesinger, M.E., Schneider, S.H., Watts, R.G., Wigley, T.M., and Wuebbles, D.J. (1998) Energy Implications of Future Stabilization of Atmospheric CO2 Content. Nature, v. 395, pp. 881-884.

Somerville, C. (2008) The Billion-Ton Biofuels Vision, pp. 28-30 in Science Magazine’s State of the Planet 2008-2009 (D. Kennedy, Editor), Island Press, Washington D.C.